Introduction

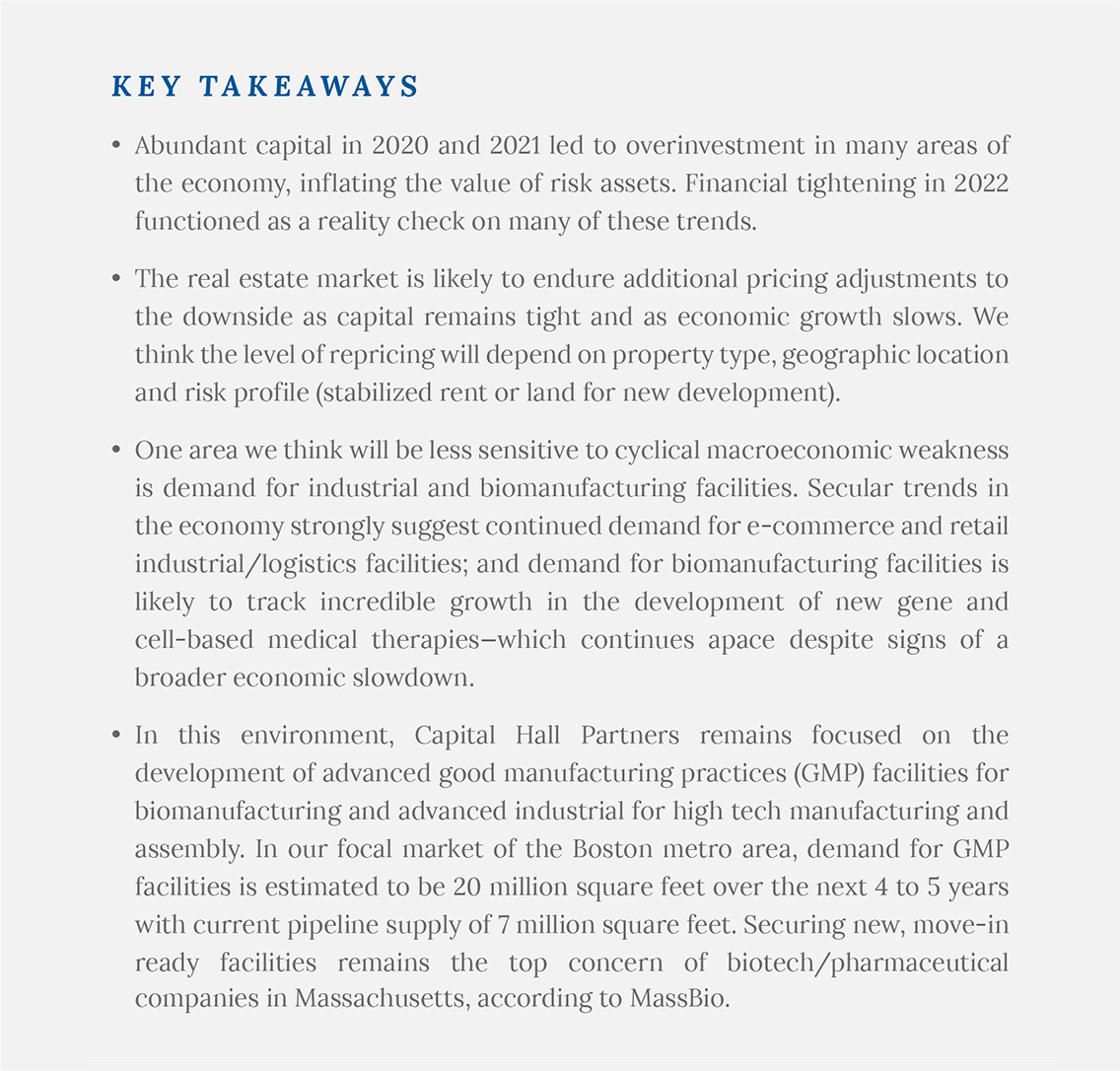

Asset prices surged in 2020 and 2021, as unprecedented levels of liquidity sloshed around the capital markets. Trillions of dollars in new fiscal stimulus—much of which was directly transferred to households—combined with unprecedented expansion of the Federal Reserve’s balance sheet and quantitative easing (QE) measures, which kept interest rates low. Pricing and development activity across the real estate markets felt brisk tailwinds during this period, making it a rewarding time to own and/or be a developer of real assets.

In 2022, however, the “easy money” party ended.

Inflation’s upside surprise caused the Federal Reserve to aggressively shift from quantitative easing (QE) to quantitative tightening (QT), and fiscal stimulus ran its course. The tide that lifted all boats suddenly and quickly receded back to sea.

In 2022 alone, the Fed raised its benchmark interest rate from 0.1% to 4.4%. Elsewhere in fixed income, the yield on the 10-year US Treasury bond more than doubled from 1.6% to 3.88%, high-yield spreads moved from 3.5% to 5.2%, and mortgage rates rose from 3.1% to 6.4%. This rapid tightening of financial conditions had a chilling effect on available capital and capital flows across real estate markets.

Looking ahead, we think capital is likely remain slow-moving until lenders and investors have a clearer understanding of where and when the interest rate cycle will peak. Barring a negative inflation surprise, we believe this peak will arrive by mid-year 2023, as we explain in the next section.

Inflation and the Fed – Our 2023 View

Inflation has been trending in the right direction for several months, which has allowed the Federal Reserve to be less aggressive with rate hikes. The 50 and 75 basis point rate increases of 2022 finally gave way to quarter point increase in the first meeting of 2023.

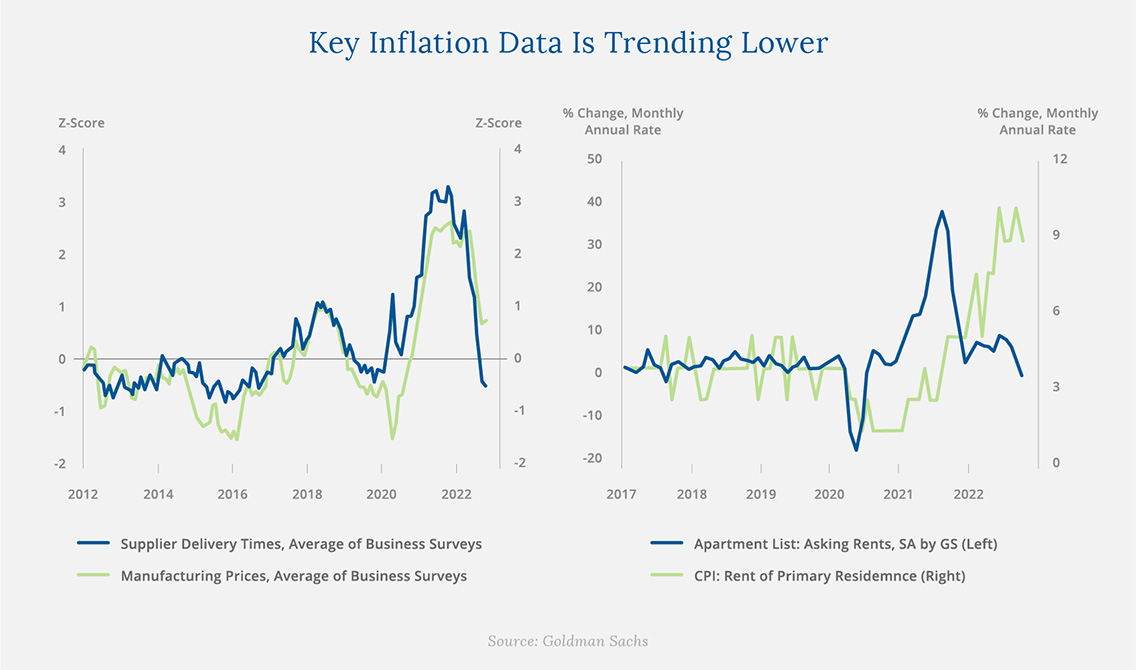

Supply chain disruptions that forced goods prices higher have largely faded. This has given way to falling costs for semiconductors, used cars, gas, appliances, and a range of other goods that contributed significantly to last summer’s inflation surge. Inflation in the manufacturing sector has also improved greatly, as measured by the prices-paid index and supplier delivery times (see left-hand side of chart below).

From a real estate perspective, housing is poised to bring inflation down in the coming months. Existing home sales have fallen -32% over the past 10 months, and home prices have also come down from peak levels. In the rental markets, the supply of new apartments hit a 40-year high, and more than 500,000 new apartment units are expected to hit the market by the end of 2023 – the highest total since 1986. We’re already seeing rents falling from peaks in many major cities, but this improvement is yet to show up in headline inflation data since it works on a lag (see right-hand side of chart below).

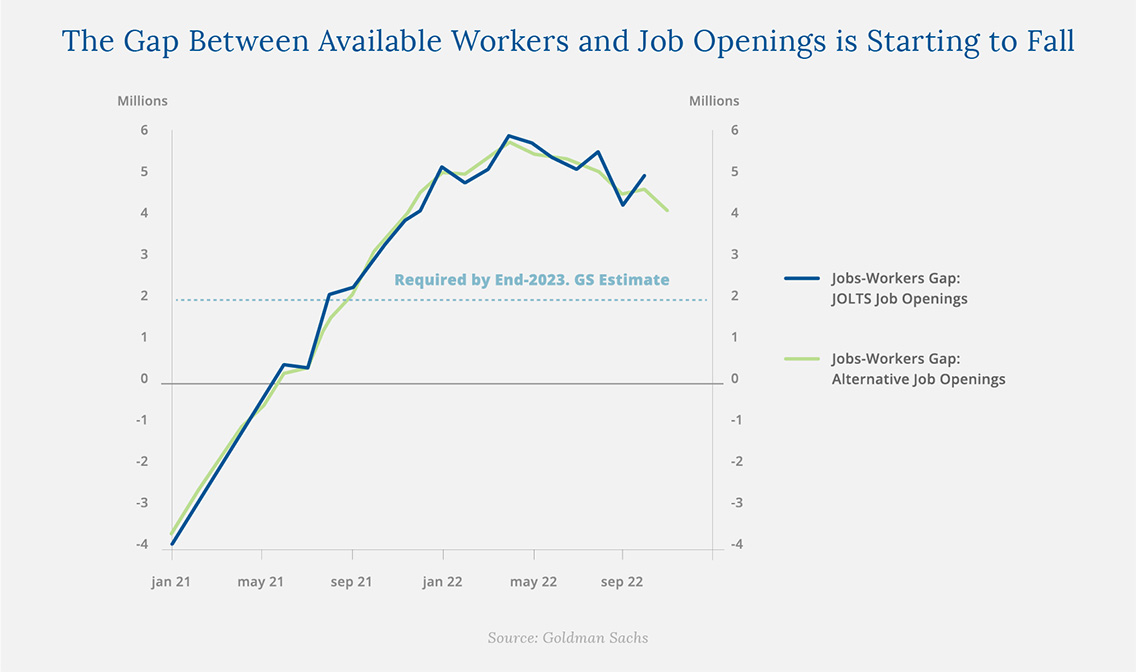

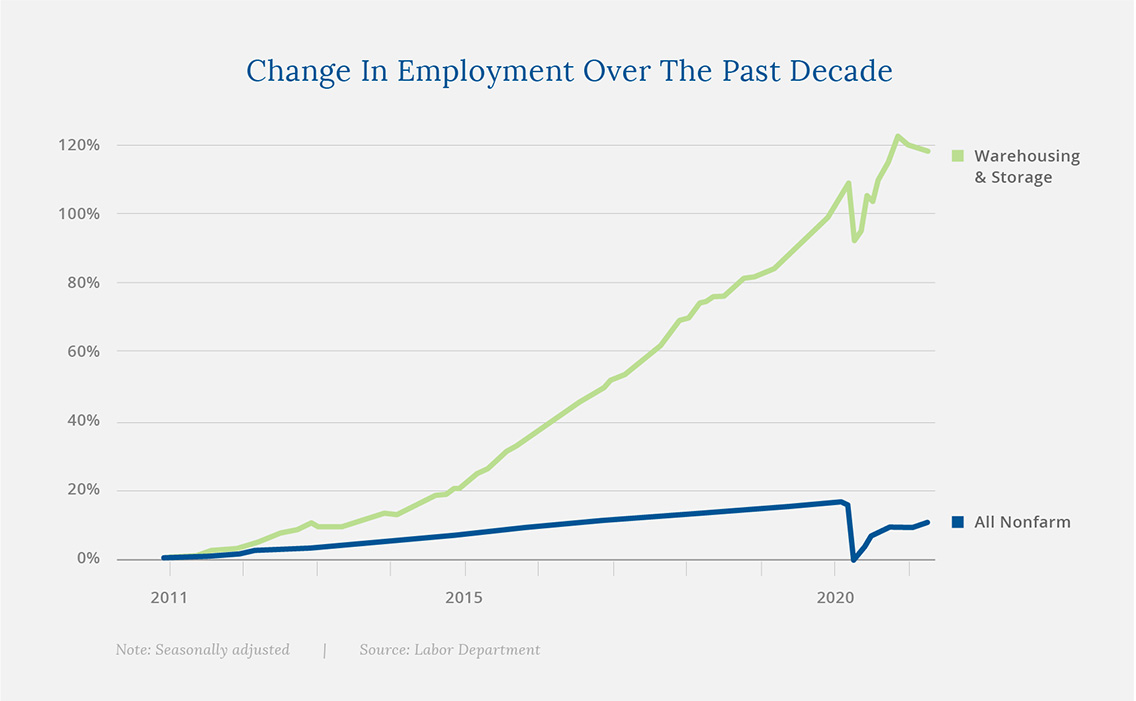

Goods inflation is clearly trending in the right direction, but the Fed is now fixated on ‘services’ inflation, which tends to have closer ties to the jobs market and wages. In comments following the Fed’s December meeting, Chairman Powell said “the labor market continues to be out of balance, with demand substantially exceeding the supply of available workers.” This imbalance puts upward pressure on wages, which in turn influences companies to raise prices to make up for higher costs—a so-termed “wage-price spiral.”

Early signs of labor market weakness are apparent in high-profile layoffs being announced by technology companies. But small businesses (under 250 employees) continue to hire and raise wages, and there are approximately 10 million open jobs in the US economy. The Fed likely wants to see the number of available jobs scale down before committing to pausing rates. The good news is that the ratio of open jobs to available workers only needs to shrink to 2 million (from the current 4 million) to bring wage growth down to a rate compatible with the Fed’s 2% inflation target, according to Goldman Sachs. The jobs market is currently trending in that direction:

By mid-year, we think the Federal Reserve is likely to find that fed funds rate is higher than CPI, and that job openings have fallen enough to cool wage inflation pressure. This scenario would make the peak of the interest rate cycle much easier for investors and market participants to forecast, which we think will allow capital to start flowing again as the defined cost (interest rates) will be a known quantity.

In our focal area of real estate investing – GMP life sciences facilities – supply has been affected by 2022’s capital crunch, but demand has remained firm. We think the coming peak in the interest rate cycle makes a strong case that capital will start to move again, positioning the sector for a solid rebound in 2023.

Our Outlook for GMP and Life Sciences Real Estate

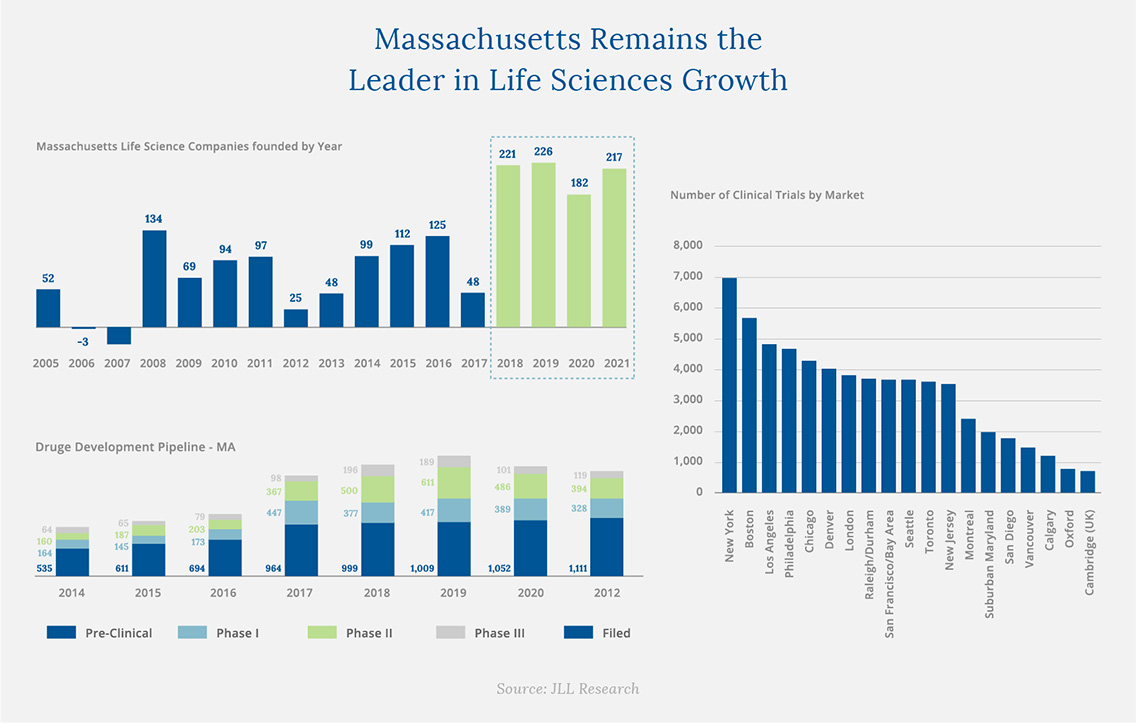

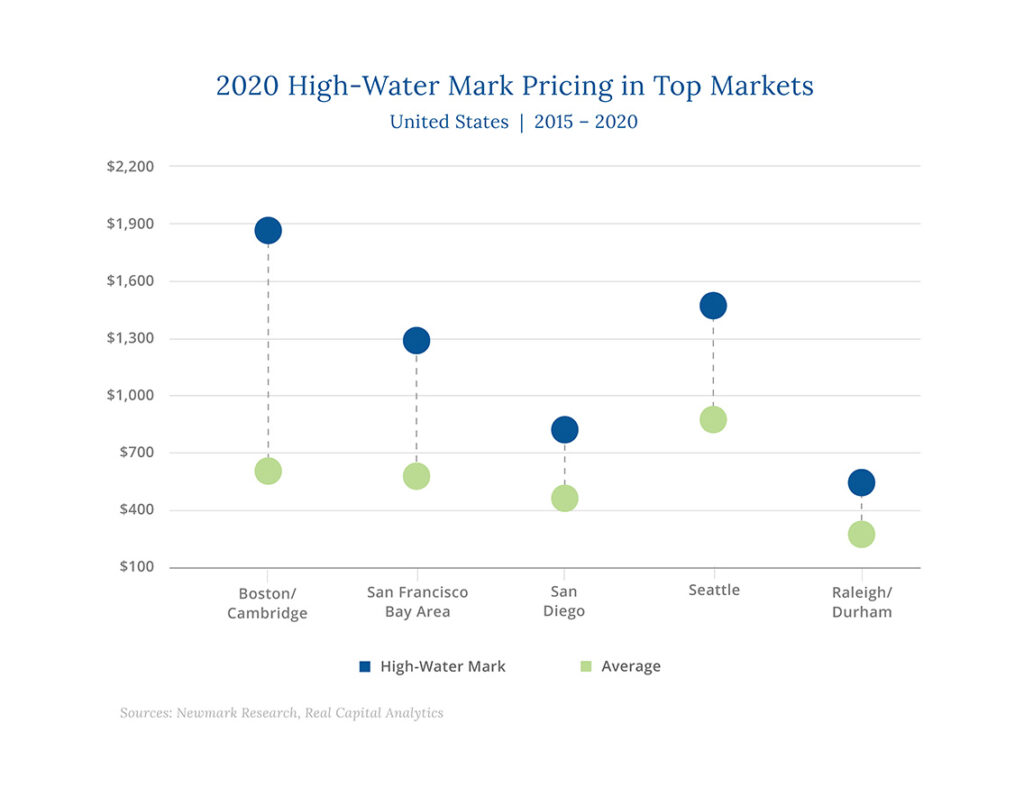

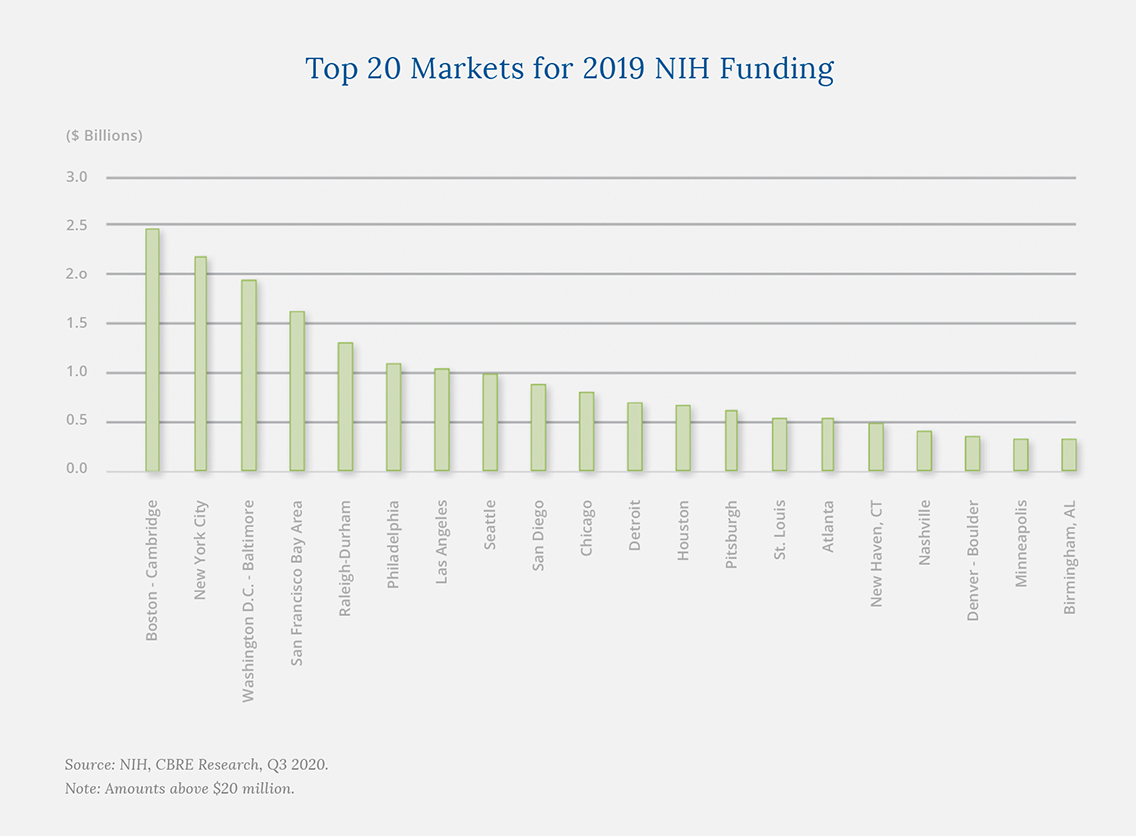

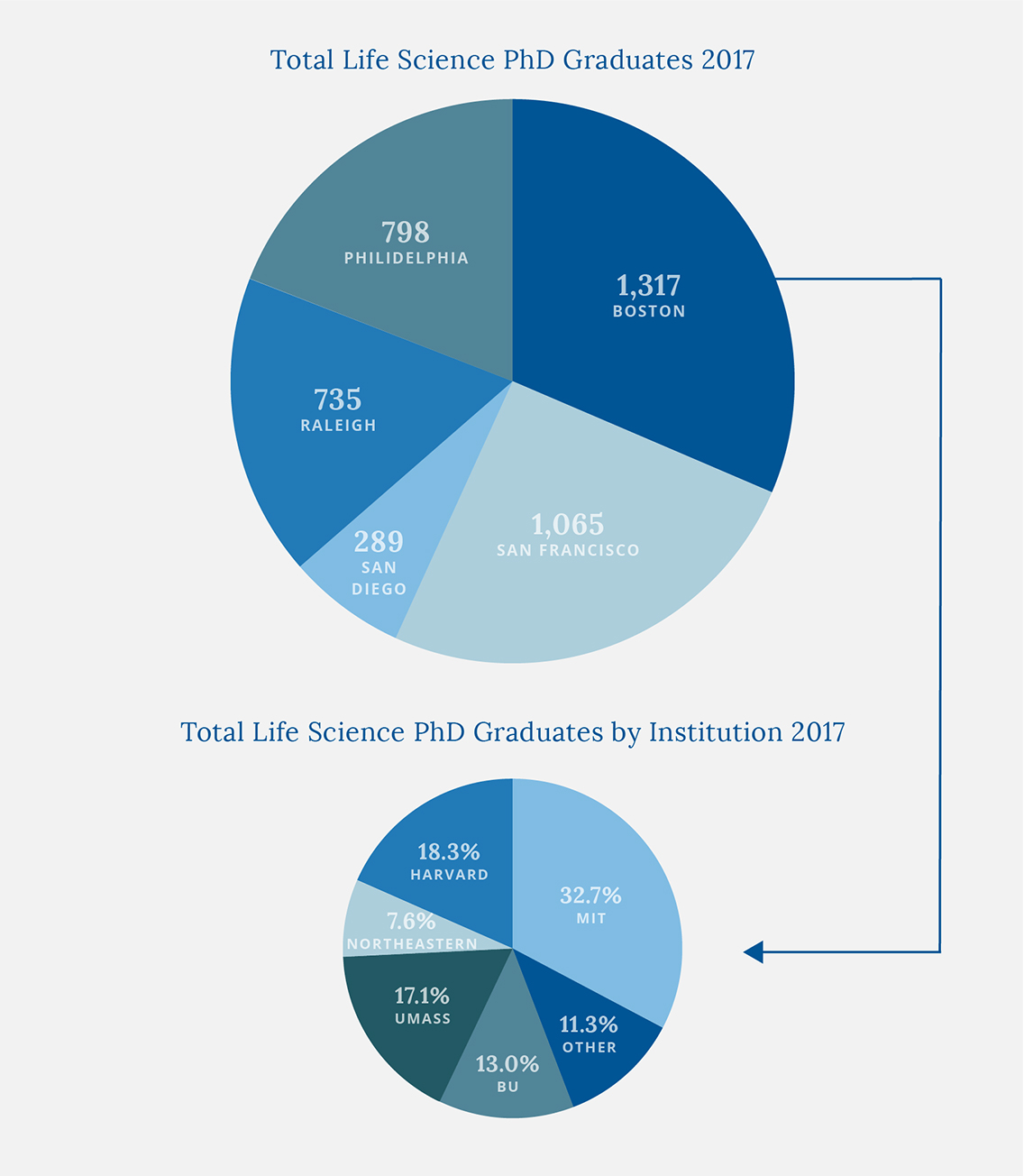

Capital Hall Partners’ focus continues to be in Boston, which remains the undisputed center of industry for life sciences in the US.

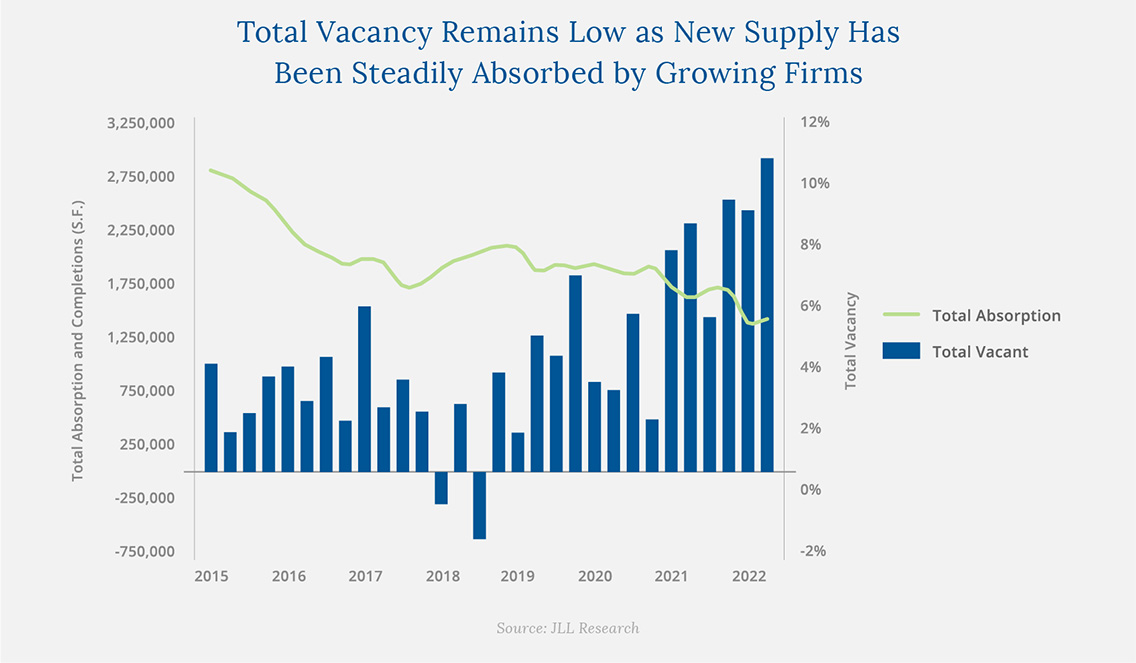

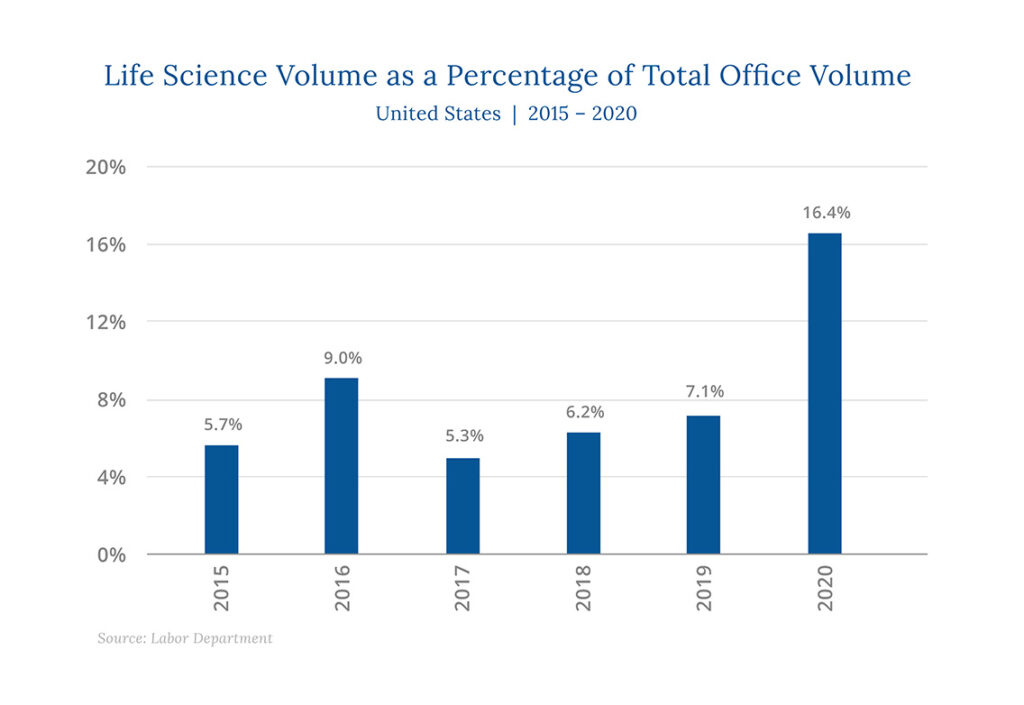

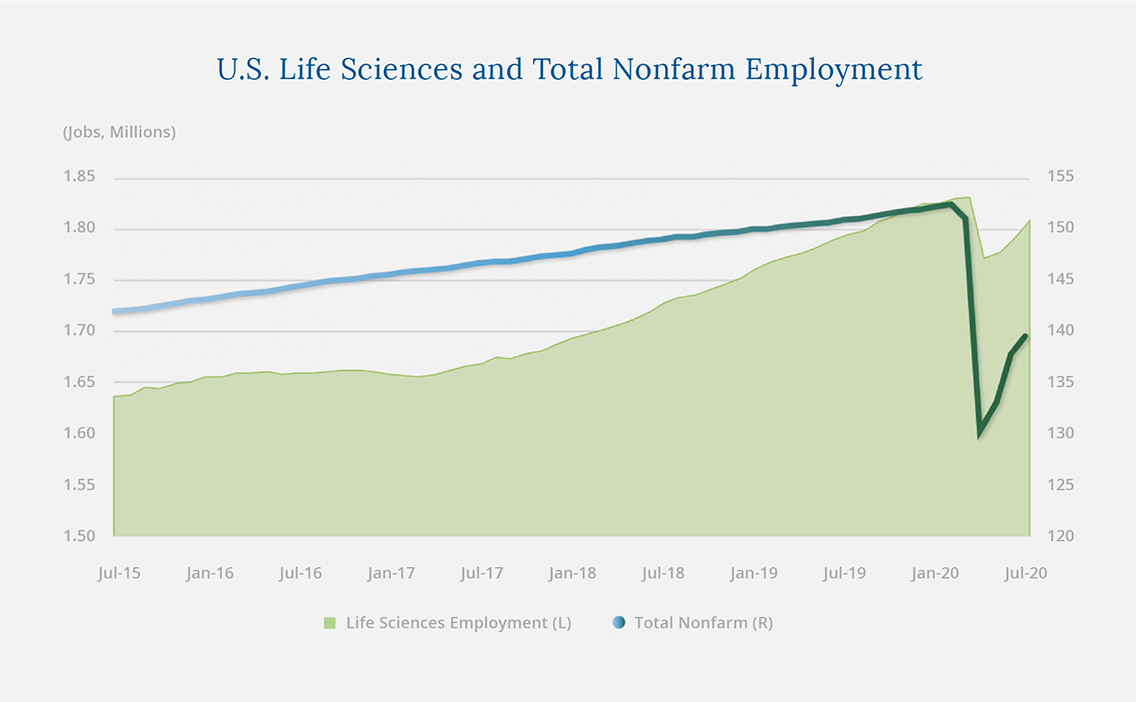

Boston saw demand for lab and manufacturing space double from mid-2020 to mid-2021, with available supply notably lagging behind. Most of the top life sciences markets had a similar experience.

But even with demand falling in 2022, it remains above pre-pandemic levels and space remains limited, with vacancy below 6% when looking at the top life sciences markets in aggregate (which of course includes Boston):

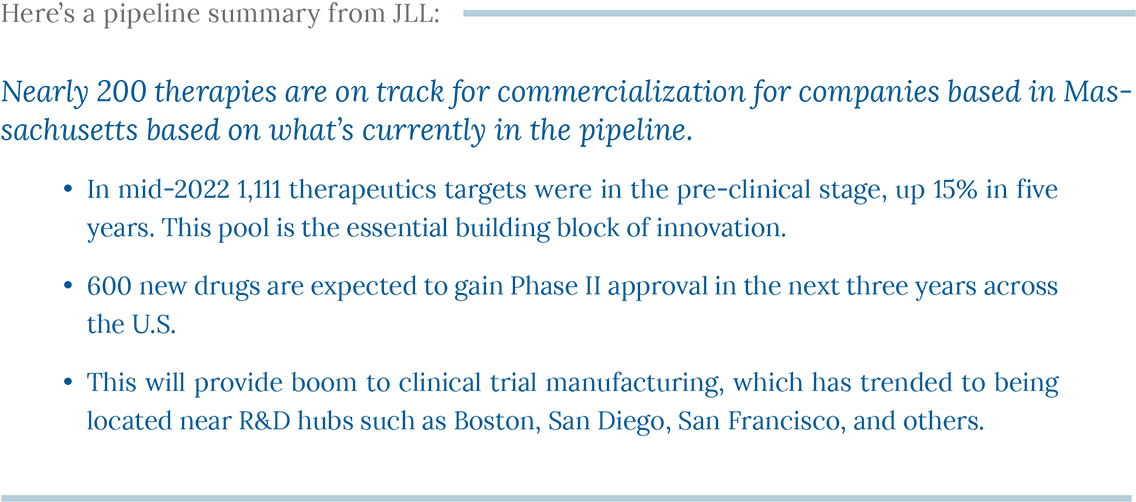

The fact that demand for GMP and R&D life science space has remained elevated is a byproduct of the engine of innovation that characterizes the life sciences industry. As pointed out by JLL, “science doesn’t stop.”

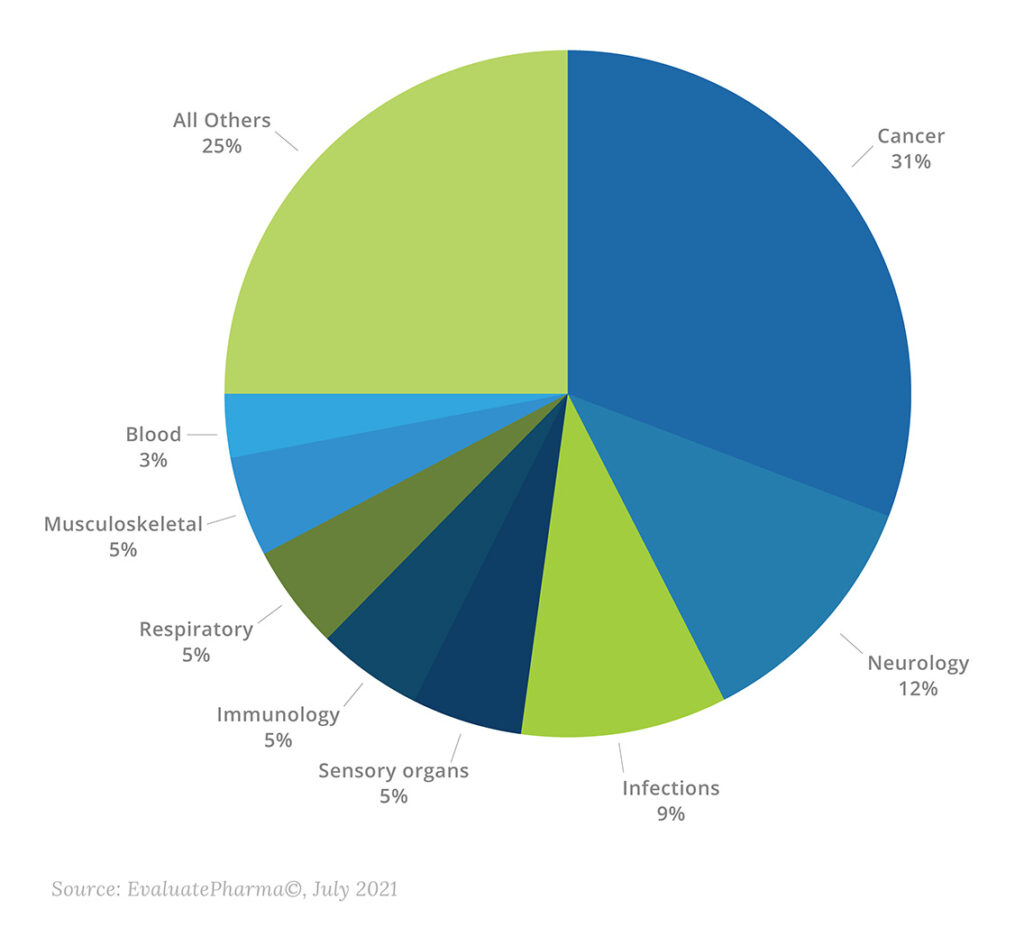

No industry is recession-proof, but the sheer pace of innovation and discovery that is happening in life sciences today suggests that any slowdown is just a short-term correction creating pent-up demand within a firm long-term uptrend. There is no hyperbole in stating that we’re living in a historic moment, where decades of research into cell and gene therapy are finally being converted into once unconceivable drug treatments and therapies.

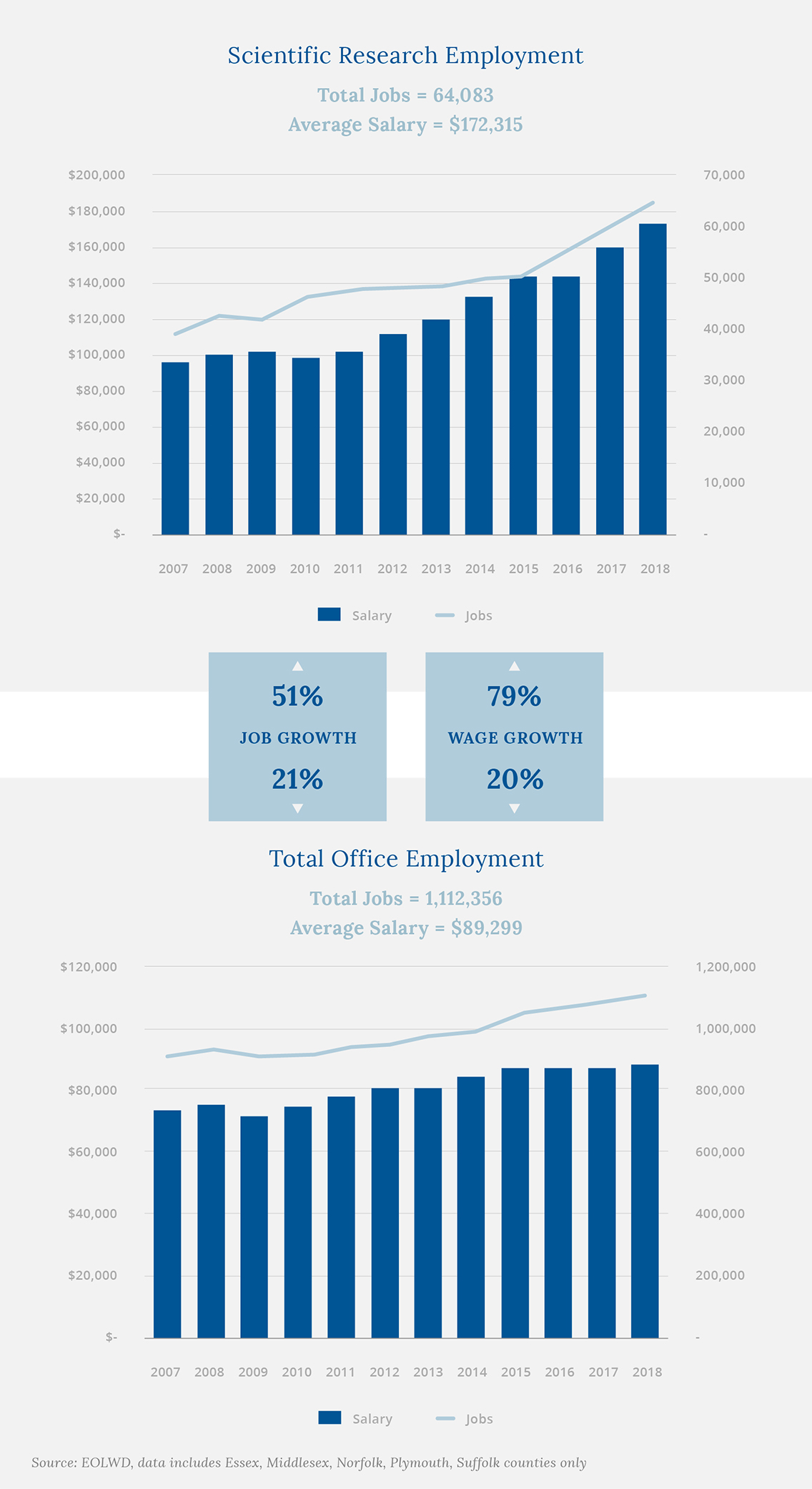

It follows that revenue growth has soared over the last five years as the life sciences sector becomes larger. Of the five biggest years of annual revenue for biotech R&D in the last 20 years, three of them have occurred in this period.

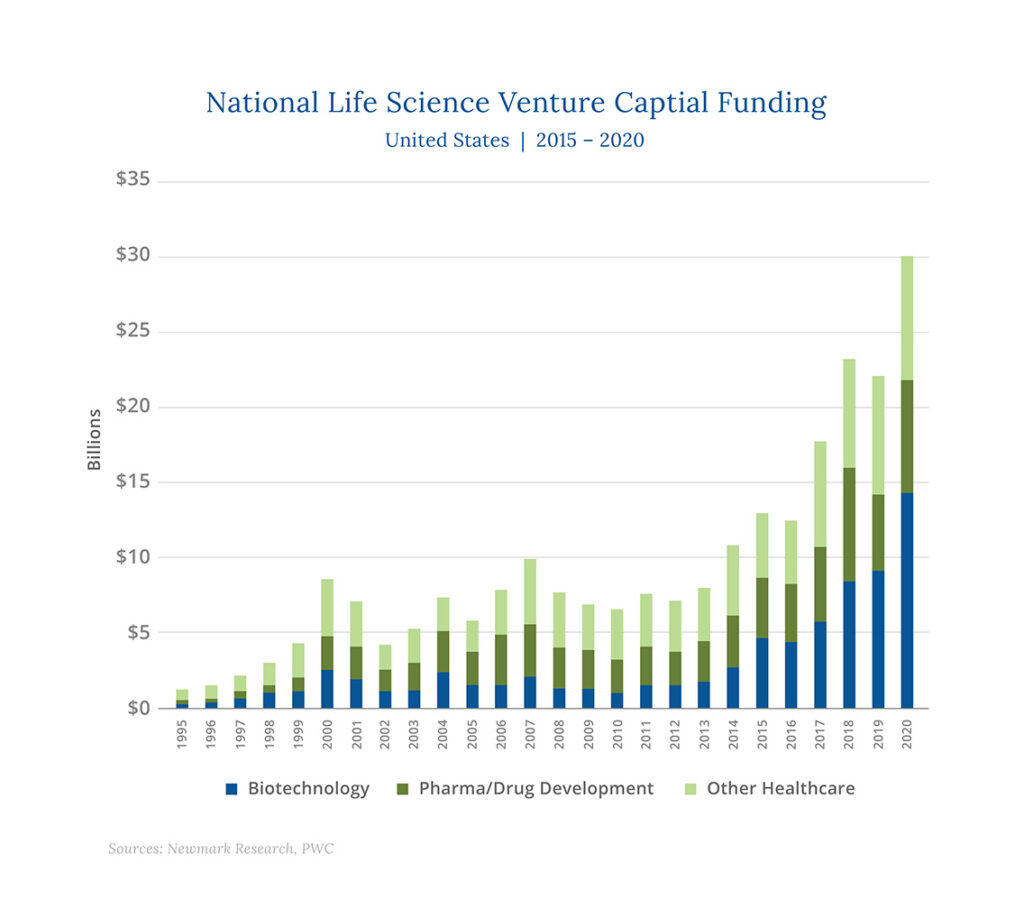

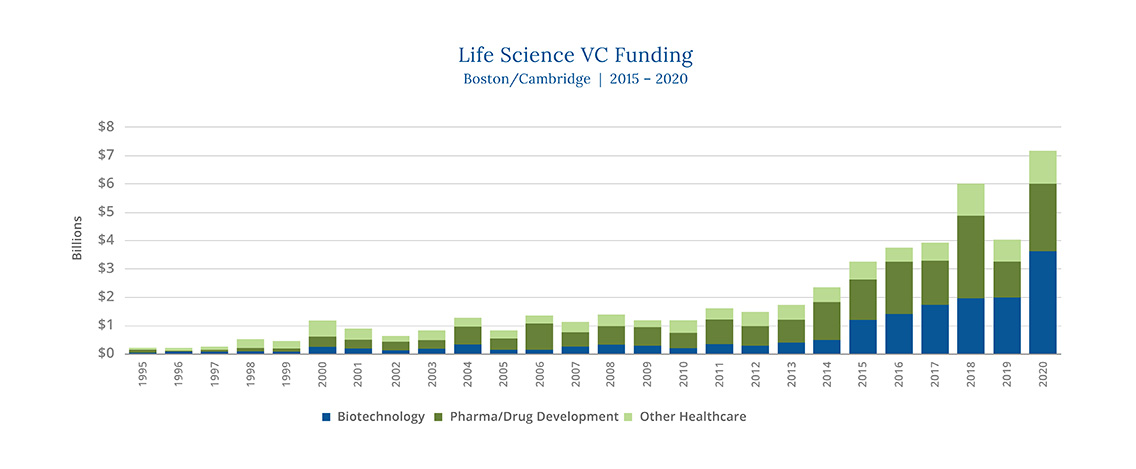

Boston and the greater Massachusetts market has absorbed much of this growth, as you can see in the charts below:

From a real estate supply standpoint, tight financial conditions hit the sector in 2022, and we saw a notable stall in the GMP manufacturing segment. But it’s worth noting that some of the pullback started to occur before the Fed started to get aggressive with rate hikes. As the cost of capital went up over the course of the year, projects stalled even more. In our view, this only exacerbated an already existing supply-demand imbalance with pent-up demand growing.

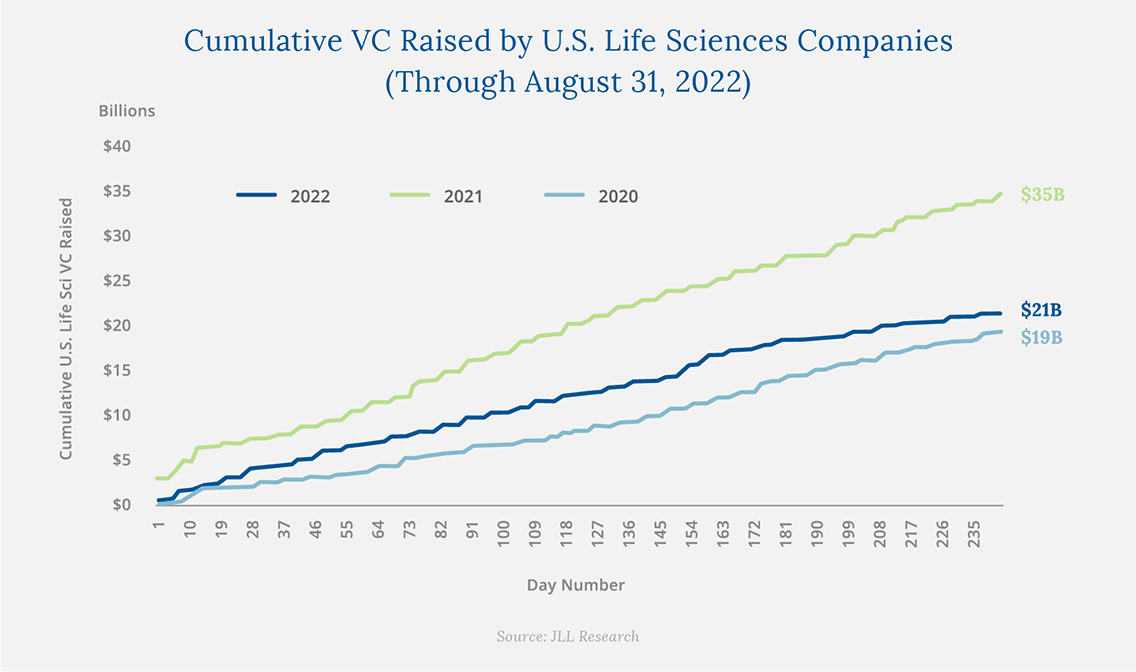

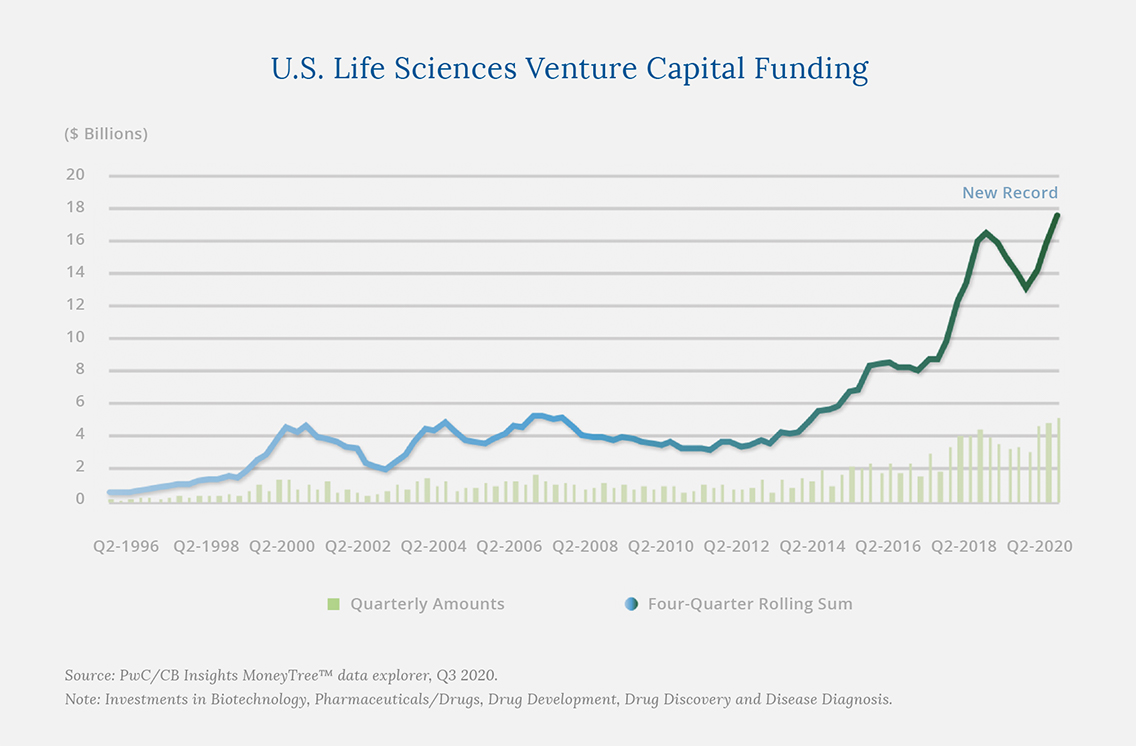

Capital flows played a role in the supply slowdown as well, with VC funding falling -38% in 2022 from peak 2021 levels. But some context is important here, given that 2021 was the high-water mark for VC funding. As seen in the chart below, though venture capital funding showed a marked decrease from 2021 levels, it was still higher than 2020:

In 2023, capital constraints could ease as the interest rate peak becomes clear, but we could also see major pharmaceutical companies and established biotechnology companies become active in the partnership and acquisitions space for the foreseeable future. Start-up valuations are attractive, and fresh injections of capital are not as easily procured as they have been in years past. Large biopharmas have massive amounts of cash on balance sheets, and investment opportunities are plentiful in the early-stage market.

From JLL: “For the first time, many early-stage tenants in the market have move-in-ready space that requires little capex, a key consideration as many boards and investors are preaching cash preservation in a tight funding environment. The upshot is these spaces are highly sought-after short-term solutions in the market and have seen a good deal of leasing activity at good rents.”

Conclusion

The demand for drug treatments and therapies that help us live longer, healthier lives is inelastic. Weak economic growth and tight capital may slow it down from time to time, but the desire to innovate and bring therapies to market is far too strong for it to be stopped.

The life sciences sector is poised for tremendous growth for the foreseeable future. Over 50% of all healthcare spending in the US is driven by those aged 55 and older, a cohort that currently makes up 30% of the population is expected to grow from 96 million today to around 110 million in 2030. A rapidly growing pool of consumers means demand for novel therapies, innovative new modalities and increased adoption of advanced technologies will continue to drive investment over the long-term. With growing demand comes the need for more biomanufacturing GMP and R&D life science space.

Capital Hall Partners continues to move forward with development of GMP assets we currently own, and in 2023 we are looking to expand our pipeline of future investments in both GMP and industrial facilities.

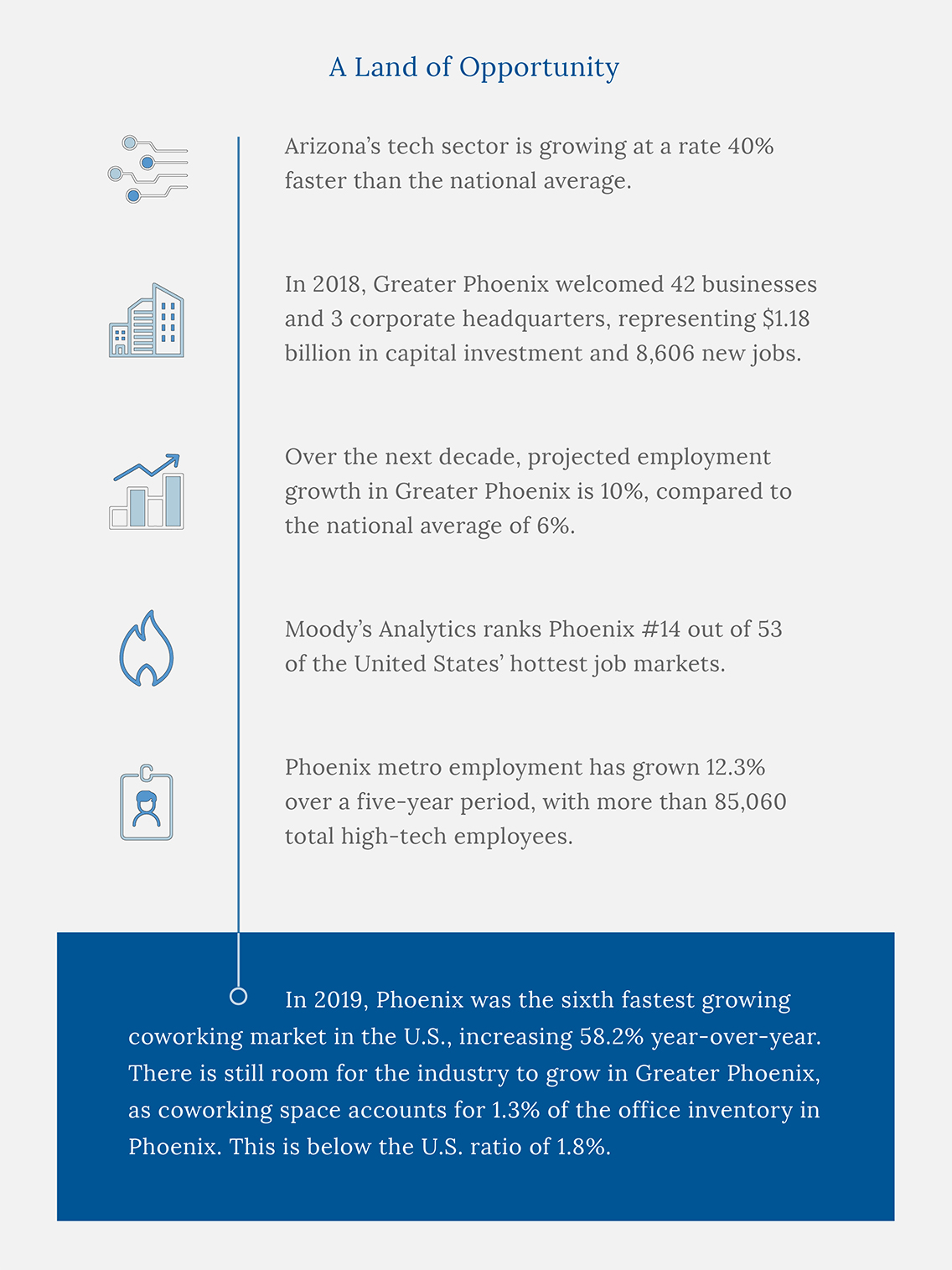

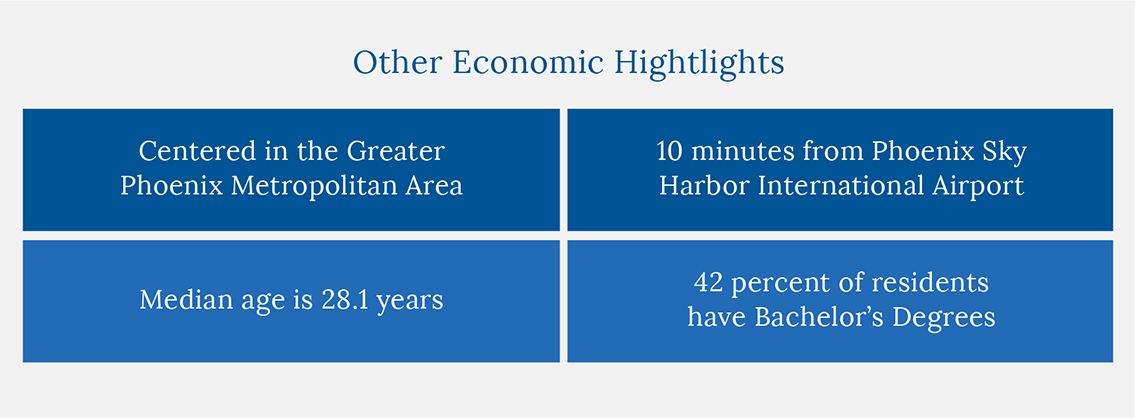

Capital Hall Partners is a privately-held real estate investment and development firm. We have over 50 years of experience over multiple real estate cycles, with a current focus on value-oriented investments in the Los Angeles, Phoenix, & Boston areas. Our commitment to investors is to preserve capital, deliver attractive risk-adjusted returns, be trustworthy and transparent.

If you would like to learn more about Capital Hall Partners, please contact us today at info@caphall.com.

Source: Fundrise

Source: Fundrise