The investment landscape today looks materially different than it did before the pandemic, across many asset classes and industries. For its part, commercial real estate held up remarkably well. Prices fell far less than in the wake of the 2008 financial crisis, and the market has retraced losses considerably over the past year. Pension funds and private-equity firms are once again spending record sums on buildings.

To be fair, however, the commercial real estate market looks a lot like the broader U.S. economy: some areas of the market are thriving and charting strong growth forecasts, while other areas are struggling to claw back to pre-pandemic levels.

The prices of malls and hotels, for instance, are down significantly, and in cities, office vacancy rates are at elevated levels. Looking ahead, loan defaults and foreclosures in these areas are expected to increase as forbearance periods end, the government withdraws fiscal support over time, and as lenders eventually lose patience. The upshot is that losses should be lower than originally expected, and far from losses experienced in the 2008 financial crisis.

In this somewhat fragmented market, Capital Hall Partners is naturally shifting focus to the real estate opportunities with more robust medium- to long-term outlooks. There are two key areas—detailed below—we think will produce strong growth opportunities now and over the next few years, if not longer.

TREND #1

Life Sciences Office, Lab, and Bio-Manufacturing Space

The life-sciences sector has been a significant bright spot in commercial real estate over the last year. The pandemic brought global attention to the critical importance of innovation in life sciences, pharmaceutical drug discovery, and it accelerated the commercialization of gene-based therapies. During the early 1990’s, the biotech industry made revolutionary scientific break-throughs in understanding our genetic makeup and DNA. Today, those break-throughs are being used to develop gene-based therapies for the treatment of numerous human disease and illness.

Demand is on the rise. 131 life sciences companies went public via IPO in 2020, raising over $22 billion globally. This is roughly triple 2019 figures. Venture capital funding in the space also reached record levels at $22.5 billion, representing a 39% increase over 2019.

We know one of the biggest trends over the last year was in the shifting of work from offices to home. But scientists cannot develop drugs and therapies from home offices. They need physical lab space, with specialized designs, ventilation, and other key secure infrastructure measures.

TREND #2

Logistics and Warehouses

In the first half of 2020—which was also in the throes of the pandemic—demand for big warehouses surged 51% (according to Colliers International). For sites 750,000 square feet or larger, net absorption came to 34.3 million square feet in the first six months of 2020, which is more than double the total amount recorded for all of 2019. The shift towards e-commerce and away from ‘just in time’ inventory management led many companies to scramble for warehouse spaces to use as logistics centers for processing, packaging, and shipping digital orders.

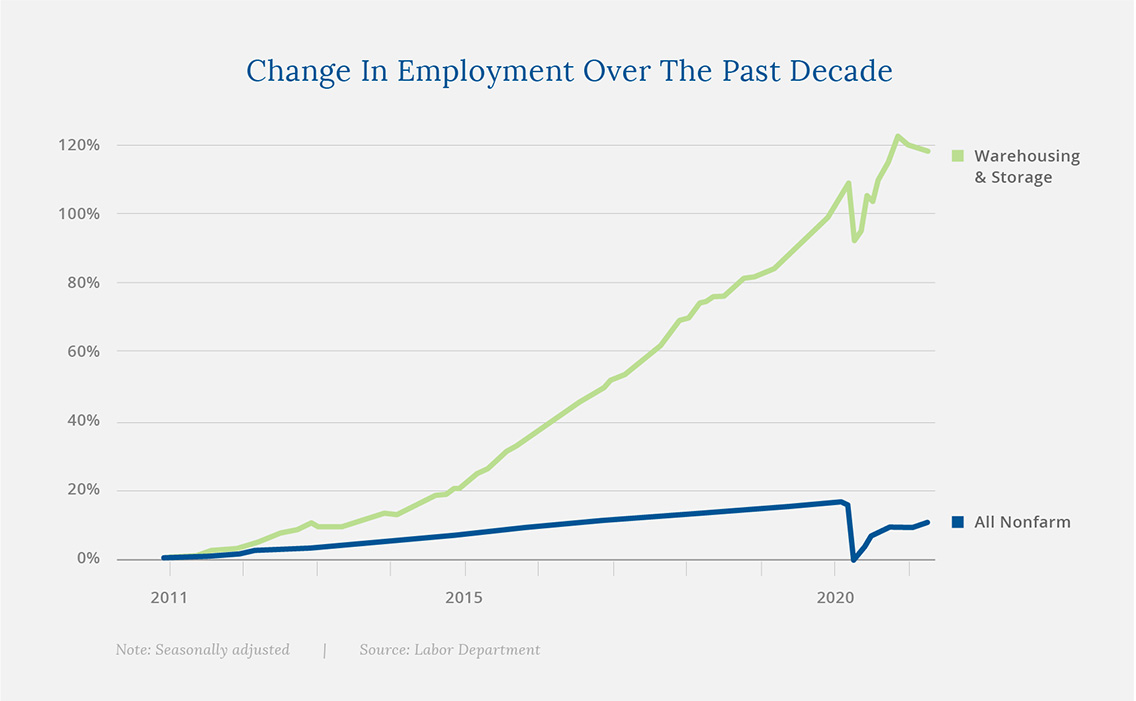

Amazon, of course, was at the center of this accelerated push. The company leased nearly 30 million square feet in the first half of 2020 alone, and was estimated to occupy some 100 million square feet across the U.S. by the end of last year. All told, Amazon has over 600 facilities in the U.S. alone and has been a huge driver of employment in the sector over the last decade:

Investor interest is on the rise. More recently, foreign property investors—who once focused on urban markets, skyscrapers, and urban shopping corridors—are shifting their focus to suburban and urban warehouses and logistic centers for “last-mile” delivery of retail products. According to a report in the Wall Street Journal, a subsidiary of France’s AXA Investment Managers bought a majority stake in 27 U.S. logistics facilities from Cabot Properties for $875 million last December. Germany’s Allianz Real Estate announced it had purchased a 49% stake in a U.S. logistics portfolio in partnership with Crow Holdings, and the National Pension Service of Korea bought 23 warehouses last year in a $2 billion deal with Stockbridge Capital Group.

In our view, the surge of interest in warehouse/logistics space is not a one-time phenomenon. We see it as part of a secular shift in retail and other consumer-oriented businesses, with companies increasingly reaching customers online versus in-store. In other words, demand for warehousing and last-mile logistics space is only likely to increase in the years ahead.

Uncovering Opportunities in High-Demand Markets

Given the recent surge of demand for warehousing/logistics and life sciences real estate, more investors and developers are expected to enter the respective spaces. Blackstone Group, for example, recently agreed to pay $3.45 billion for a portfolio of buildings in Cambridge (where Capital Hall Partners has a presence), which followed a recapitalization of BioMed Realty for $14.6 billion. The firm is betting on lasting demand in life science clusters.

Even with increasing participation by institutional investors (and foreign investors) in the logistics and life sciences space, we believe secular economic trends in consumer retail and life science R&D/bio-manufacturing will continue to drive demand for both last-mile logistics and life science lab space higher in the years to come. Companies are increasingly shifting away from brick-and-mortar stores to the e-commerce/delivery/pick-up model, and the life sciences sector is at an all-time high for funding and is expected to continue to fuel growth in research, development and manufacturing.

Capital Hall Partners is actively pursuing investment opportunities in both warehousing/logistics and life sciences. We’re already developing two Life Sciences campuses in the Greater Boston Area, the Gateway Innovation Center and Brickyard @ Assembly project, and we will continue to pursue new opportunistic deals to meet our ESG investment philosophy standards.

Due to limited supply in both these areas of commercial real estate, more operators, developers and investors will enter the space. But we think it’s the established operators and developers— like Capital Hall Partners—who will have a clear advantage by possessing technical experience within the asset class. Our deep research, institutional experience, commitment to ESG and value-oriented approach will help us navigate new opportunities in a high-demand market.

To learn more about our projects or who have questions about our firm, please reach out to us at info@caphall.com. We’d be happy to talk with you.

Capital Hall Partners is a privately-held real estate investment and development firm. We have over 50 years of experience over multiple real estate cycles, with a current focus on value-oriented investments in Qualified Opportunity Zones in the Los Angeles, Phoenix, & Boston areas. Our commitment to investors is to preserve capital, deliver attractive risk-adjusted returns, be trustworthy and transparent.

If you would like to learn more about Capital Hall Partners, Qualified Opportunity Zones, or our work in Boston, please contact us today at info@caphall.com.